Cost of Doing Business

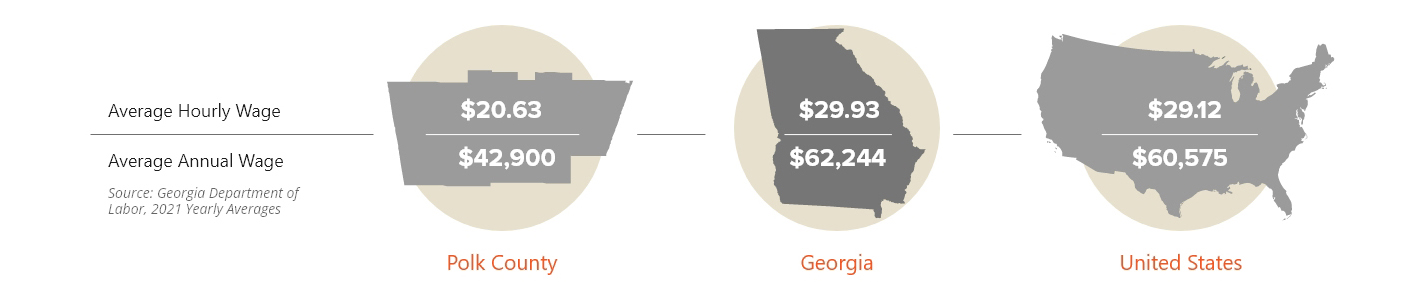

Polk County does not impose an excise tax on energy used by manufacturers, which makes Polk County more competitive than many surrounding counties. Additionally, a wage rate lower than the U.S. average keeps business costs in check.

Wages

While the prospects for workers continue to improve, the area is still attractive to investors considering expansion. Labor costs are moderate compared to other areas in Georgia and the country, which can help companies improve their bottom lines. In Polk County, it is possible to lower business costs while offering competitive wages for qualified workers.

| Major Employment Sectors | Average Weekly Salary |

|---|---|

| Construction | $1,237 |

| Manufacturing | $1,078 |

| Wholesale Trade | $1,154 |

| Retail Trade | $689 |

| Transportation/Warehousing | $1,012 |

| Finance/Insurance | $976 |

| Scientific & Technical Services | $915 |

| Admin., Support, Remediation | $870 |

| Healtdcare & Social Assistance | $991 |

| Government (All) | $899 |

| All Sectors | $896 |

Source: Georgia Department of Labor, Polk County Area Labor Profile, 2022 Q3

Polk County Sales Tax

Property Taxes

In Georgia, property is required to be assessed at 40% of the fair market value unless otherwise specified by law. The tax rate, or millage rate, is set annually by the County’s municipalities and the Polk County Board of Education. A tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value.

Millage Rates, FY2024

| Aragon | 6.490 |

| Cedartown | 10.684 |

| Rockmart | 7.57 |

| County Incorporated | 6.903 |

| County Unincorporated | 6.903 |

| Polk County Schools | 14 |

Business Incentives

Businesses that consider Polk County quickly discover how easy it is to do business here. Everything from fast-track permitting, aggressive financing methods, business advocacy and creative problem-solving are available to qualified projects. Bottom line – Polk County’s Development Authority Team can and will do what it takes to earn your company’s trust and investment.

Local Incentives

- Single Point of Contact

- Property Tax Abatement – case by case

- Freeport Inventory Tax Exemptions – 100% on raw materials, goods in process of manufacture, and finished goods and held for less than 12 months and destined for shipment out of state

- Manufacturing Energy Sales Tax Exemption – Energy used by manufacturers is exempt from the 7% sales tax (4% state, 3% local)

- Fast-Track Permitting

- Creative Financing – through Industrial Revenue Bonds, Leaseback Agreements, PILOT Agreements

- Local Fee Waivers

- No Impact Fees

- Cities of Rockmart and Cedartown carry an ISO 3 fire rating

Workforce/Hiring/Training Assistance

- Georgia Department of Labor (DOL)

- Labor Market Information

- Onsite Business Centers

- Recruitment and Staffing

- Assistance with Tax Credits and Employment-related Laws

- A variety of other programs

- Georgia’s Quick Start Program, the internationally recognized, customized workforce training is a state incentive at no cost to qualified companies.

- Georgia Northwestern Technical College can provide customized training opportunities, as well as traditional programs of study.

- Polk County College & Career Academy is a public/private initiative designed to accommodate the workforce needs of business and industry, offering both internships and dual enrollment opportunities.

State Level Incentives

- Job Tax Credits – $3,500 per job each year for 10 years, minimum 2 qualifying jobs. (Polk County is a Tier 2 county)

- Port Job Tax Credit Bonus – $1,250 per job bonus added to the job tax credit for businesses with large increases in shipments out of a Georgia port

- Investment Tax Credit – 5%-8% of qualified capital investment; companies must choose either the investment tax credit or the job tax credit

- Childcare Tax Credit – up to 75% of the employer’s direct cost of providing or sponsoring childcare for employees, or 100% of the cost of purchasing or constructing a qualified childcare property for employees

- Manufacturing Machinery and Computer Sales Tax Exemptions – sales and use tax exemptions on qualified tangible personal property under certain specified conditions

- Quick Start Training – customized, world-class training for new and expanding industries and businesses, at no cost to qualifying businesses

- To learn more about tax credits your company could qualify for, explore the 2024 BUSINESS INCENTIVES brochure.